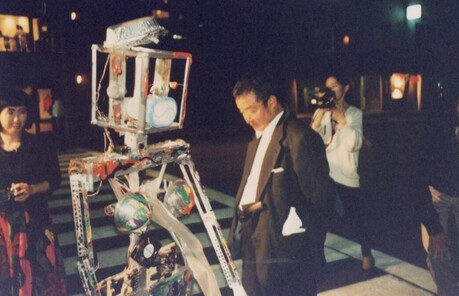

China's private museum sector is grappling with a wave of closures and financial difficulties as the country's spectacular museum-building boom of the 2010s comes to an end. The art world was particularly shocked in August 2022 when Guangzhou's beloved Times Museum announced it would shut down that autumn, marking a symbolic end to an era of rapid expansion that had already been threatened by COVID-19 and economic slowdown.

Since 2003, Times Museum's small space atop an apartment building had hosted some of Asia's most provocative exhibitions and nuanced scholarship while building a strong community around contemporary art. However, the museum was funded by Times Property, and when China's long-predicted property sector implosion finally arrived, the cultural institution became collateral damage. While Times Guangzhou relaunched last year as a project space, many other closures have been permanent.

The casualties have been mounting across China's major cities. The Shanghai location of OCAT, part of a chain of property-development museums that once operated in Beijing, Shenzhen, and Xi'an, closed indefinitely in summer 2021 after public outrage over a controversial video work ranking women's attractiveness. As COVID restrictions deepened, the museum never reopened. Qingdao's TAG Museum announced this summer that it was suspending operations, while Nanjing's much-vaunted Sifang Art Museum now appears to function primarily as a rental space for events.

Other prominent institutions have dramatically scaled back their operations. Yinchuan MoCA and Shanghai MoCA now mount only modest, occasional exhibitions, far from their former ambitious programming. The future of Long Museum in Shanghai and Chongqing also seemed precarious in 2023 when its wealthy owners auctioned part of their massive collection, though the institution has continued operating.

"The sector has entered a post-boom phase," says Li Anqi, a curator and historian who focuses on Chinese museums. "The initial rapid expansion—at times, a craze—has cooled down, which is a natural development as perpetual growth is unrealistic." The museum boom of the 2010s brought China hundreds of new art institutions, many of them vanity projects established by eager new collectors or attached to property developments seeking increased foot traffic and tax breaks.

According to China's National Cultural Heritage Administration, the country had 7,046 registered museums in 2024, an increase of 213 from the previous year. Researchers Fenghua Zhang and Pascal Courty found that between 1996 and 2015, the number more than tripled from 1,210 to 3,852. However, beyond the initial fanfare of flashy facilities and eye-watering budgets, only a few dozen of these museums established reputations for consistent curatorial visions and exhibition programming.

"This current moment presents a valuable opportunity for museum founders to reflect on their work and focus on how to sustainably operate and maintain existing ones," Li explains. Philip Tinari, director and chief executive of UCCA, which operates several locations in China, describes 2025 as "a moment of consolidation." He notes that discourse was previously dominated by ideas of infinite expansion, but now China is moving toward a more mature approach where contemporary art has "a specific set of possibilities and audience and reception around it."

The shift has led to new models of cultural patronage. "There are a lot of private individuals who ten or 15 years ago would have been the kind of people to start museums," Tinari observes. "That passion is getting channeled into slightly more contained and focused projects." Collector-backed foundation spaces are proliferating as people realize that "a lot goes into starting and running museums—it's not as easy as it looks."

UCCA itself has faced scrutiny amid the sector's challenges. The institution, which launched in Beijing in 2007 and has expanded to projects in Beidaihe, Yixing, Shanghai, and most recently Jincheng in Shanxi province, was the subject of a July report in the South China Morning Post alleging cashflow issues had caused delays to staff salaries. UCCA responded that the article was "riddled with inaccuracies and exaggerations" and claimed to be pursuing legal proceedings. However, the South China Morning Post stands by its reporting, stating the article "was prepared following a comprehensive research process" and "accurately reflects the substance and context of the matters discussed."

Similar financial rumors have affected other institutions, with tax investigations, backdoor art sales, and messy divorces among the situations reportedly facing private museums. "It has become clear that many private museums born from this boom failed to establish sustainable funding models or cultivate in-house curatorial and educational teams—both are essential for a museum's long-term survival," Li notes. "The private museums that continue to operate such as Rockbund Art Museum [in Shanghai], He Art Museum [Shunde], and By Art Matters [Hangzhou] are typically those with sound financial operations and professional staff who are paid reasonable salaries and given opportunities to learn."

He Art Museum (HEM) represents one success story in navigating the current challenges. Founded in 2021 by He Jianfeng, a prolific collector and son of electronics manufacturer Midea's founder, HEM receives support from a foundation structure that executive director Shao Shu describes as "quite healthy." This funding model means "the museum would not be easily influenced by the economy, environments, or if the company made bad investments and lost money."

HEM charges 150 yuan ($21) for admission, though discounts and free admission reduce the per-person average to just under 100 yuan ($14). The museum sold around 400,000 tickets last year but expects a 20% drop this year due to economic pressures. "Museum tickets are a dispensable luxury when income shrinks," Shao explains, noting that while China's growth is projected at 4-5% for this and next year, youth unemployment hit 18.9% in August.

The museum deliberately avoids the commercial gallery-funded selling exhibitions that have sustained many other private institutions, though this revenue stream has slowed significantly. Even lucrative fashion brand exhibitions have become less common. HEM's tickets and merchandise currently cover exhibition costs, with a goal of achieving full financial independence within a decade.

The challenges extend beyond individual institutions to broader demographic and policy issues. While the ranks of contemporary art lovers in China are growing, the pace is slow, and many visitors find contemporary art challenging. The economic slowdown has disproportionately affected the young, educated demographic that forms the core museum audience, with many leaving China or relocating from expensive major cities to cheaper smaller towns.

Government-backed Chinese museums have increasingly moved toward free admission in recent years, which Shao believes cuts into private museums' visitor numbers. "People who don't care about quality will choose whatever is cheaper," he notes, adding that "traditional cultural things showing at the national museums are easier for people to connect with."

Public-private collaborations have shown mixed results, with Qingdao's TAG Museum suspending operations after losing backing from a cash-strapped local government. "The call for systematic support for private art museums has been voiced for years, yet meaningful policy progress remains limited," Li observes. Compared with public museums—particularly those promoting traditional culture and values or serving as instruments of foreign relations, like Shanghai's West Bund Museum with its ten-year partnership with Centre Pompidou—private contemporary art museums remain especially vulnerable to economic and political pressures.