Wealthy women significantly outspent their male counterparts on art purchases in 2024, spending 46% more according to the latest Art Basel and UBS Survey of Global Collecting 2025. The comprehensive report also found that women are more willing to take risks by purchasing works from unknown artists compared to men, challenging traditional assumptions about gender and investment behavior.

The 200-page report surveyed 3,100 high net worth individuals (HNWIs) who are active art buyers across ten markets in mid-2025. The study aims to identify who is buying what, where, from whom, and for how much, providing insights into future market trends. The research is particularly significant as much of today's blue-chip art market has been built on the preferences of predominantly male Boomer and Silent Generation collectors.

Women's growing influence in the art market reflects their increasing control over global wealth. By the end of 2024, women controlled over one-third of global wealth, a share that continues to rise rapidly. According to UBS's 2025 Gender-Lens Investment Report, an estimated $32 trillion in global spending is managed by women, and 75% of discretionary spending globally is expected to be controlled by women within five years.

Economist Clare McAndrew, the report's author, deliberately ensured this year's sample was evenly split between men and women to analyze gender differences in collecting habits. The study also covered a broad age range to assess how art buying might change with the next generation, with 74% of respondents being Millennials and Gen Z collectors. McAndrew emphasized that these collecting reports differ from the annual Art Basel and UBS Art Market Report, as they survey a broader group of wealthy individuals about their tastes and spending patterns rather than providing a market temperature check.

Despite continued geopolitical and economic uncertainty, coupled with tariffs and increased barriers to cross-border trade, HNWIs continued to actively spend on art, antiques, and collectibles. The surveyed HNWIs spent an average of 20% of their wealth on art collections, up from 15% in 2024, while ultra-high net worth individuals with over $50 million in assets averaged 28%. Across all respondents, average spending totaled $438,990, with collectors purchasing an average of 14 works.

Generational differences in spending patterns emerged clearly from the data. Boomers, although representing the smallest sample, were the biggest spenders at almost $993,000, followed by Millennials at $523,000. However, Gen Z clients were spending comparatively more of their wealth on art at 26%. Notably, 90% of Gen Z respondents who had inherited artworks said they planned to keep them, while 80% across all age ranges planned to pass their collections to their children.

The report revealed fascinating differences in collecting preferences across generations. While Boomers concentrated primarily on paintings, Millennials and Gen Z demonstrated broader tastes. Millennials spent the most on decorative art, design, and jewelry. Contrary to the common belief that Gen Z prioritizes experiences over material possessions, they spent the most on average in various sectors including handbags, classic cars, boats, jets, and remarkably, five times more than other age groups on sneakers, averaging $19,440 on second-hand shoes.

Digital art showed surprising resilience despite the NFT market crash. Twenty-three percent of HNWIs said they planned to buy digital art, up from 19% in the previous survey, with 26% of Gen Z collectors expressing plans to purchase digital works. However, paintings remained the most popular genre across all demographics, with 48% of HNWIs planning to buy paintings over the next year, followed by sculptures at 37%.

Gender differences in collecting preferences were notable throughout the study. While 41% of women planned to buy paintings and 22% sculptures, 54% of men planned to buy paintings and 40% sculptures. Women showed higher interest than men in purchasing all mediums except paintings, sculptures, and works on paper, including photography, installations, textile-based art, and digital art. Despite digital art being a male-dominated field, women's collections contained 15% digital art compared to 11% in men's collections.

The spending gap between wealthy women and men was particularly pronounced among younger generations. Millennial women reported spending an average of $643,700 in 2024, one of the highest overall figures, while Gen Z women spent $537,400, more than double that of men in the same age group. Geographic variations were striking, with Millennial women in Mainland China averaging $3.9 million in 2024, while those in Japan spent just over $1 million.

"Women are going to be a very powerful demographic," McAndrew observed. "Mainland China is always an outlier in these surveys, but when I see something consistently, year after year, in these surveys it means it's quite a serious thing. Even though we talk a lot about a drop at the high end of the market, there are still these bizarrely high spending pockets, like these women in China, Japan and Brazil, too, who spend much more than their male counterparts."

For the first time, the report found a correlation between female collectors and their support of female artists. On average, 49% of works in women's collections were by female artists, compared to 40% in men's collections. In the United States, this figure rose to 55% for women's collections, and 54% in Japan.

Challenging stereotypes about risk aversion, the survey revealed that women were more open to purchasing works by newly discovered, untested artists. In 2025, 55% of women said they had often or frequently bought works by unknown artists, compared to 44% of men, despite 52% of all participants viewing such acquisitions as high risk.

McAndrew explained the complexity of risk assessment in art collecting: "We asked a whole series of questions on risk aversion in different areas, everything from financial and investment risk to social situations to healthcare, it was fascinating. I had to do a lot of background reading to frame the questions and all the academic papers say that women are more risk averse." She noted that consequences faced by women might make them appear more risk-averse, as society judges women's failed attempts more harshly than men's.

The report also examined purchasing channels, revealing significant shifts in how collectors acquire art. While galleries and dealers remained the dominant sales channel at 83% in 2024 and the first half of 2025, auction house usage dropped dramatically from 74% in 2023 to 49% in 2024/25. Younger collectors showed less reliance on traditional platforms, preferring to buy through various means.

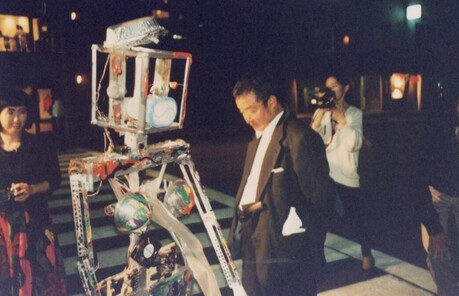

One of the most significant changes was the marked rise in direct-from-artist sales, now the second-most popular channel across all markets. Sixty-three percent of surveyed HNWIs had bought works directly from artists, a sharp increase from 27% in 2023 and 43% in 2022. Most of these sales occurred through artists' studios (43%), while 37% of HNWIs had commissioned works (up from 15% in 2023) and 35% had purchased through Instagram.

"Direct from artist sales accounted for around 20% of spending, which is considerable," McAndrew noted. "If that is indicative of what is going on in the market, then we will have to try and find a way to capture that data. There does seem to be an appetite among collectors for buying direct from artists."

Regarding market stability, McAndrew expressed cautious optimism: "I think the fact that buying plans are okay, 40% of people are planning to buy art, is encouraging. There seem to be pockets of really strong activity—Brazil, for instance, stood out. There's more people planning to buy than planning to sell, which could be a sign of things building. There's no indications it's going to be a boom, but the report does show some stability."